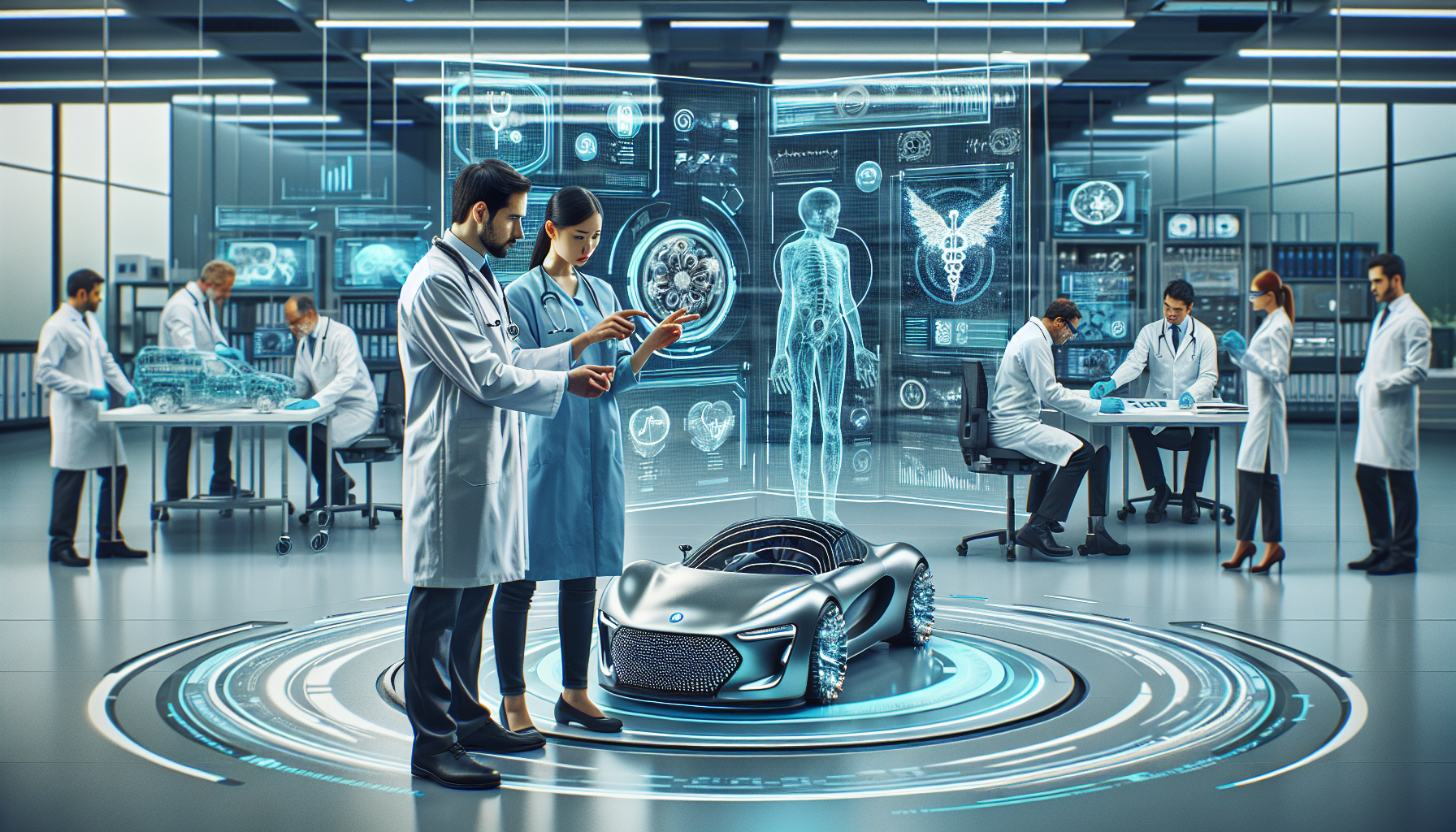

Innovative Insurance Products

The integration of healthcare and automotive technology is paving the way for the development of innovative insurance products. This fusion is not only transforming the insurance landscape but also enhancing the way insurers assess risk and provide coverage. By leveraging data from wearable health devices and connected car technologies, insurers can offer personalized and dynamic insurance solutions that cater to individual needs.

The Role of Wearable Health Devices

Wearable health devices, such as fitness trackers and smartwatches, have become integral in monitoring personal health metrics. These devices collect data on physical activity, heart rate, sleep patterns, and more. Insurers can use this data to tailor health insurance policies, offering discounts or incentives to policyholders who maintain a healthy lifestyle. This approach not only encourages healthier living but also reduces the risk of chronic diseases, ultimately lowering healthcare costs.

Personalized Health Insurance

By integrating data from wearable devices, insurers can create personalized health insurance plans. These plans reward policyholders for maintaining healthy habits, such as regular exercise and balanced diets, with lower premiums and additional benefits. This personalized approach fosters a proactive attitude towards health management.

Connected car technology is revolutionizing automotive insurance by providing real-time data on driving behavior. Vehicles equipped with telematics systems can monitor speed, braking patterns, and mileage. This data allows insurers to assess risk more accurately and offer usage-based insurance (UBI) policies. UBI policies adjust premiums based on actual driving behavior, promoting safer driving habits and reducing accident rates.

Usage-Based Insurance

Usage-based insurance policies provide a fair and transparent pricing model for drivers. By analyzing driving data, insurers can offer lower premiums to safe drivers, incentivizing responsible driving and reducing the likelihood of accidents. This model benefits both insurers and policyholders by aligning premiums with actual risk.

While the integration of healthcare and automotive technology presents numerous opportunities, it also poses challenges. Data privacy and security are major concerns, as insurers must ensure that sensitive information is protected. Additionally, the accuracy and reliability of data collected from devices must be maintained to prevent discrepancies in policy assessments.

Despite these challenges, the potential benefits are significant. Insurers can develop more accurate risk models, reduce fraud, and enhance customer satisfaction by offering tailored products. Furthermore, the integration of these technologies can lead to the development of new insurance products that address emerging risks, such as cybersecurity threats and autonomous vehicle coverage.

Future of Insurance

The future of insurance lies in the seamless integration of technology and data analytics. By embracing innovations in healthcare and automotive technology, insurers can create products that are not only more efficient but also more aligned with the needs of modern consumers. This evolution will redefine the insurance industry, making it more responsive and adaptable to change.

The development of new insurance products through the integration of healthcare and automotive technology is a testament to the industry’s adaptability and innovation. By harnessing the power of data, insurers can offer more personalized and dynamic solutions that cater to the evolving needs of consumers. As technology continues to advance, the insurance industry must remain agile and open to new possibilities, ensuring that it remains relevant and competitive in a rapidly changing world.